Car companies are expanding into the lithium mining business to secure their supplies for EV manufacturing

07/06/2023 / By Arsenio Toledo

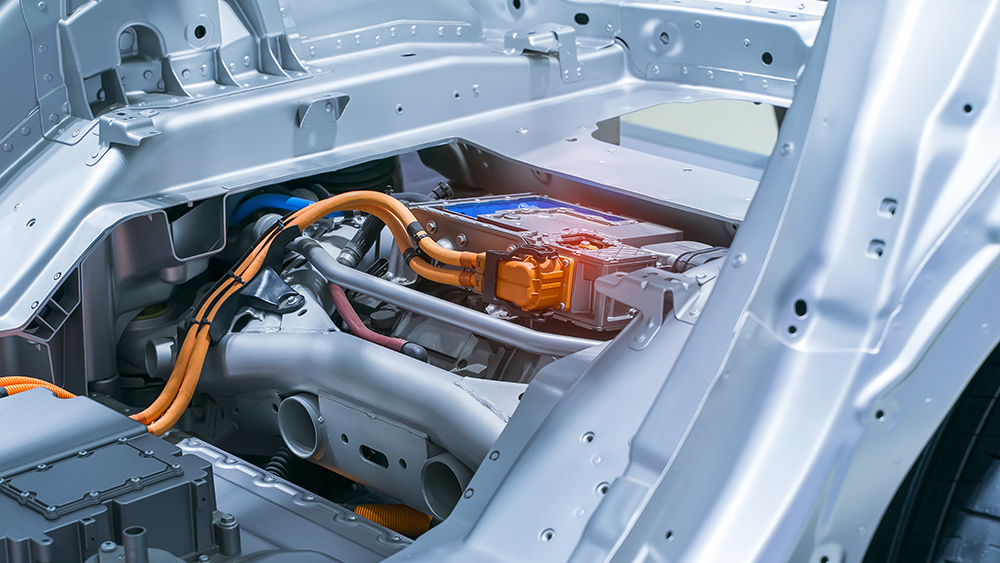

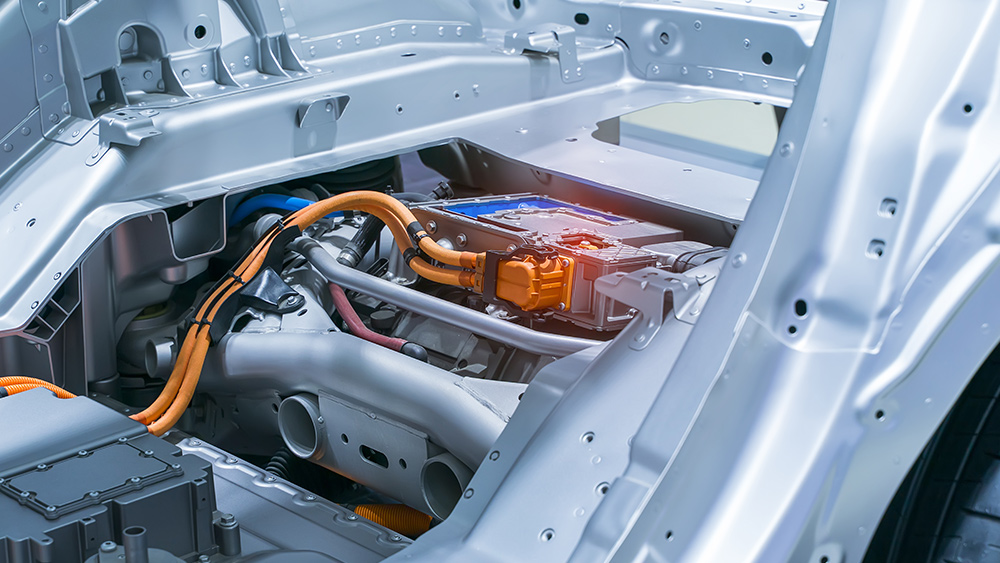

Major American car companies are expanding into the lithium mining business to prevent possible lithium supply snags for electric vehicle (EV) manufacturing.

Lithium, sometimes referred to as “white gold” for its high value and silvery white color, has fueled a new global mineral rush with the element being critical in the manufacturing of lithium-ion batteries that power EVs. And as electric vehicle ramps up, demand for the metal soars with it.

Sales of EVs, which include battery-powered cars, pickup trucks and SUVs, rose 45 percent during the first quarter of 2023 compared to the same period last year. In 2022, more than 10 million electric cars were sold worldwide, and sales by the end of this year are expected to hit 14 million – a 35 percent jump.

This growth in the demand for EVs has seen a similar boom in the mining of lithium. Until a few years ago, the price of lithium was so low, mining it was hardly profitable. But now, with most major car companies venturing into the EV business or expanding their already developed electric car sectors, there are dozens of new proposed mining projects all over the world looking for lithium. Most are still in the early development stages and will take years to begin production, but promise to make global lithium mining levels skyrocket sooner than expected, which could leave carmakers paying more for the metal than what it may be worth in the next few years.

Car companies striking deals for lithium from mines all over the world

Unfortunately for car companies, mining corporations do not have enough lithium to supply the demand coming from the burgeoning industry.

This is why car manufacturers are rushing to take control of lithium mines in places like Nevada, Quebec, Chile and Argentina. With a proper lithium mine under their control, they can secure their own supplies of a metal that could make or break their companies as they continue shifting away from internal combustion cars to electric ones.

“We quickly realized there wasn’t an established value chain that would support our ambitions for the next 10 years,” said Sham Kunjur, General Motors’ executive director for EV Raw Materials’ Center of Excellence.

Last year, General Motors struck a supply deal with Livent, a lithium company in Philadelphia, for material from some of the company’s mines in South Africa. In January, General Motors signed a $650 million joint-development deal with Vancouver-based mining company Lithium Americas, which gives the car company exclusive rights to lithium extracted from the Thacker Pass mine in northern Nevada.

Kunjur is General Motors’ lead in securing all of the battery manufacturing materials it needs to hit its target of selling two million EVs annually by 2025. Kunjur recalls how, when speaking with Lithium Americas CEO Jonathan Evans, the mining baron explained that the company was looking for two or three separate customers to buy 10,000 or 15,000 tons of lithium each, which could cost an estimated $2.3 billion to develop.

“We said, ‘We want all of it,'” Kunjur recalled.

The Ford Motor Company has struck lithium deals with SQM, a Chilean mining firm, Albemarle, based in Charlotte, North Carolina, and Nemaska Lithium of Quebec. Ford has also struck a preliminary agreement to get a certain amount of lithium from a mine currently being developed in Argentina by British-Australian mining giant Rio Tinto.

“These are some of the largest lithium producers in the world with the best quality,” said Lisa Drake, Ford vice president for electric vehicle industrialization, during a call with investors in May. (Related: Ford to lay off 1,000 employees as focus on EVs costs the company BILLIONS.)

By pouring investments into securing their supply of lithium, these car companies are hoping to catch up to Tesla, which has for years been trying to improve its access to the supplies needed to make lithium-ion batteries.

In 2022, Tesla contracted directly with mining firms or refiners for more than 95 percent of the company’s lithium hydroxide needs. And since 2014, the company has invested more than $6.2 billion into its lithium-ion battery and EV component factory in Nevada.

Auto executives are taking no chances, and dozens of other car companies have already poured billions of dollars into helping develop mining projects all over the world to secure their sources of lithium. Executives worry that if they go even a few years without a sufficient source of lithium, their companies will never be able to catch up.

With few exceptions, the deals car companies are making do not involve buying actual stakes in lithium mines. Instead, the companies are negotiating agreements in which they promise miners and refiners that they will buy a certain amount of lithium within a price range.

These deals may also give the carmakers preferential access to lithium supplies, preventing rivals from getting their hands on the lucrative mineral. Tesla, for example, has a deal with Charlotte-based Piedmont Lithium that ensures the carmaker gets first dibs on a significant portion of the output from a lithium mine in Quebec.

Learn more about the expansion of the electric vehicle industry at RoboCars.news.

Watch this clip from Newsmax of Iowa Republican Sen. Joni Ernst discussing why President Joe Biden’s electric vehicle expansion plans are not realistic.

This video is from the News Clips channel on Brighteon.com.

More related stories:

GREEN SHORTAGE: Lack of lithium preventing Indonesia from becoming a global hub for EVs.

Tesla to expand lithium refining capacity to meet growing demand for EV batteries.

Argentina sees boom in lithium production as Chile tightens control.

Sources include:

Submit a correction >>

Tagged Under:

Bubble, car manufacturers, cars, corporations, economic riot, electric cars, electric vehicles, energy supply, ford, fuel supply, General Motors, green living, Green New Deal, lithium, lithium ion batteries, lithium mine, metals, mine development, minerals, mining, power, power grid, risk, supply chain, tesla

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 POWER NEWS