Ford Motor Company scales down EV investments at Michigan plant due to declining demand and inflation pressures

12/08/2023 / By Laura Harris

The Ford Motor Company is scaling back its investment in electric vehicles (EVs) by reducing the production capacity of its battery factory in Marshall, Michigan and cutting 800 jobs.

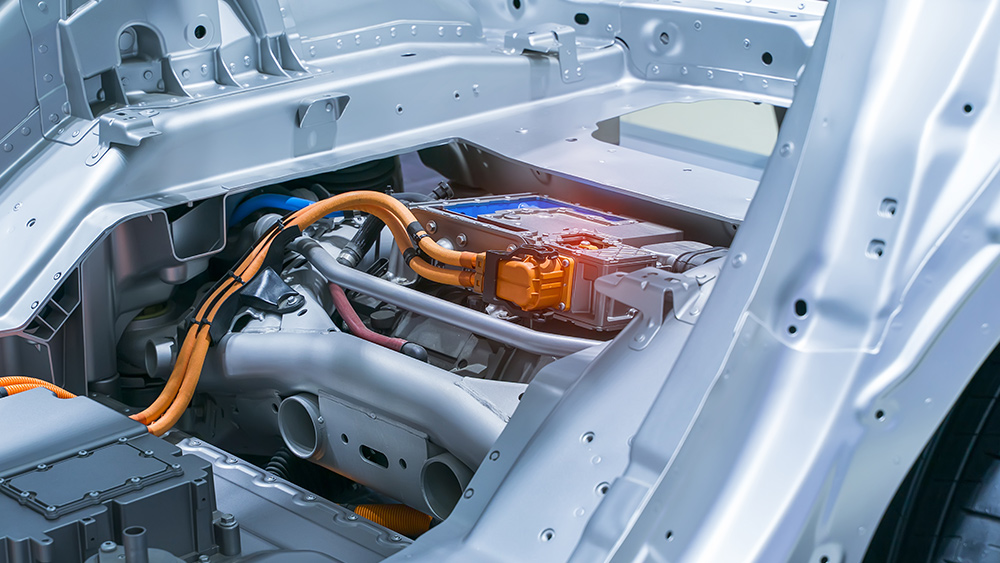

According to Ford spokesperson Mark Truby, the company initially planned to invest $3.5 billion in the factory, known as Blue Oval Battery Park, to produce 35 gigawatt hours of batteries annually with approximately 2,500 employees. Ford plans to rely on licensed Chinese technology from Contemporary Amperex Technology Co. Limited (CATL), a Chinese firm and the world’s largest manufacturer of EV batteries, to produce EV batteries at Blue Oval.

However, Ford now intends to reduce the capacity of its plant to 20 gigawatt hours of batteries annually and trim the workforce to 1,700. Similarly, the company is cutting how much it expects the Battery Park to cost by $1.5 billion.

The decision to scale back what it plans to spend on the Blue Oval Battery Park comes as inflationary pressures and declining consumer demand for EVs take their toll. CFO John Lawler said Ford, just like its competitors, is still struggling to balance the cost, profit margin, and demand for EVs, while CEO Jim Farley mentioned that affordability continues to be an issue for consumers.

As part of its plan to scale back, Ford plans to instead invest in manufacturing low-cost lithium-ion batteries by 2026 based on technology licensed from CATL. (Related: Ford pauses construction of $3.5 billion EV battery plant in Michigan amid scrutiny over CCP involvement with the project.)

Ford is also seeking approval from the Department of the Treasury for lithium-ion batteries made at the Michigan factory to qualify for Inflation Reduction Act EV subsidies. The company is currently using imported lithium ion phosphate batteries in its Mustang Mach-E electric SUV.

Ford’s partnership with CATL sparks controversy among lawmakers and residents in the area

The partnership of Ford with China-based battery maker CATL, which licenses technology for the Michigan factory, has drawn fire from lawmakers, particularly those who oppose EV subsidies benefiting a China-based entity.

“The American people deserve better from an iconic U.S. company that receives massive taxpayer subsidies. Ford needs to call off this unethical deal for good,” stated Republican Rep. Mike Gallagher of Wisconsin, chair of the House Committee on China, regarding his disappointment with the decision.

Gallagher, along with other congressional lawmakers, including Republican Rep. Jason Smith of Missouri, chairs of the House Select Committee on China and the House Ways and Means Committee, wrote a letter dated Jul. 20 addressed to Farley. They expressed their concern that the licensing agreement could contribute to the global dominance of China in EV battery technology, with U.S. taxpayer dollars potentially subsidizing it.

“Rather than developing American technology, we are concerned that the deal could simply facilitate the partial onshoring of PRC-controlled battery technology, raw materials and employees while collecting tax credits and flowing funds back to CATL through the licensing agreement,” the lawmakers wrote.

Learn more about the link between EVs and China at RoboCars.news.

Watch this clip from “Barron’s Roundtable” on Fox Business as host Jack Otter interviews Ford CEO Jim Farley about the risks associated with a widescale shift to electric vehicles.

This video is from the News Clips channel on Brighteon.com.

More related stories:

Ford halts production and shipping of F-150 Lightning EV due to unspecified battery issue.

Ford loses billions on electric vehicles, reduces its EV production target.

Ford expected to announce HUGE losses in EV sales … other automakers are bound to follow suit.

Ford lowers prices of F-150 Lightning electric trucks by up to $10,000 as EV sales falter.

Automakers cut programs and reassess future plans for EV production as consumer demand plummets.

Sources include:

Submit a correction >>

Tagged Under:

Blue Oval Battery Park, Bubble, business, CATL, China, Collapse, debt bomb, debt collapse, economic collapse, economic riot, economy, electric cars, electric vehicles, energy supply, EV batteries, EVs, finance riot, ford, green living, Green New Deal, inflation, market crash, Michigan, money supply, power, risk

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 POWER NEWS