New British Prime Minister proposes 200 billion pound spending program to subsidize UK’s soaring energy bills for two years

09/09/2022 / By Arsenio Toledo

Newly elected British Prime Minister Liz Truss announced on Thursday, Sept. 8, that her government would place a price cap on soaring consumer energy bills for two years as a way to deal with the worsening cost of living crisis. Economists warn that such a scheme could cost British taxpayers 200 billion pounds ($231.66 billion).

This massive government intervention into the British economy is surprising for Truss, who has described herself as a free market, low tax and small-state conservative. Truss claimed she has been forced to act due to the scale of the crisis. She went on to blame Russia’s war on Ukraine on the quadrupling of energy prices. (Related: 1 in 4 Brits won’t use their heaters this winter amid skyrocketing energy prices.)

“This is the moment to be bold. We are facing a global energy crisis, and there are no cost-free options,” said Truss in a speech before the House of Commons. “We are supporting this country through this winter and next, and tackling the root causes of high prices so we are never in the same position again.”

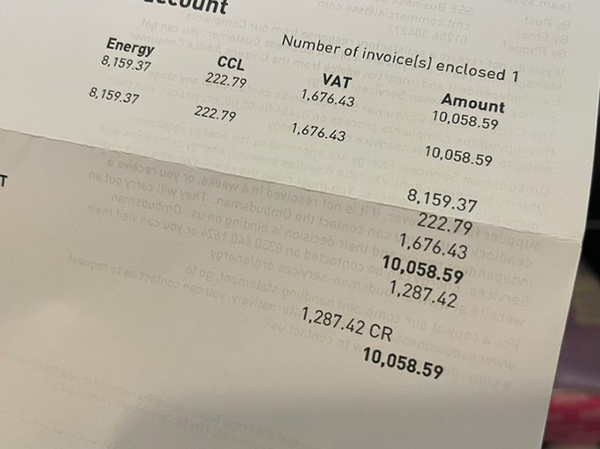

The new prime minister said the two-year “energy price guarantee” means average household bills for electricity and heating will be no more than 2,500 pounds sterling ($2,899) per year.

Before this announcement, the country’s cap on energy bills was set to increase to 3,500 pounds ($4,059) per year beginning in October. This would have represented an 80 percent increase from the current average annual bill of 1,971 pounds ($2,286).

Truss’ government claims the price cap will cut the United Kingdom’s soaring inflation rate by four to five percentage points. With inflation expected to rise to 13 percent by year’s end, such a decrease could help prevent a recession, according to the Bank of England.

In addition to the price cap, Truss said the country will look to increase its supply of energy. She announced an end to a moratorium on fracking and the issuing of new oil and gas exploration licenses for the North Sea.

“Energy policy over the past decade has not focused enough on securing supply,” she said.

Borrowing-financed price cap to increase UK’s national debt by 10 percent

Conservative estimates of how much the price cap will cost put the final price tag at around 100 billion pounds ($115.97 billion). Other estimates put the actual cost to British taxpayers as high as 200 billion pounds.

Truss’ price cap plan means that energy suppliers will “receive funding from HM [His Majesty’s] Government” to cover the difference between what they are legally allowed to charge consumers and what the wholesale market rates for energy are.

The government is set to finance this massive expense largely by borrowing tens of billions of pounds to fund the first few months of the price cap program.

As currently drawn up, the price cap package includes 130 billion pounds ($150.83 billion) of spending on household bills until April 2024 and a 67 billion pounds ($77.73 billion) discount scheme for the energy bills of businesses for 12 months.

Borrowing 200 billion pounds would drive the British government’s budget deficit to levels not seen since the Great Recession. The added expense is also expected to increase the U.K.’s national debt of 2.3 trillion pounds ($2.67 trillion) by about 10 percent.

Learn more about the global energy crisis at NewEnergyReport.com.

Watch this clip from Fox Business discussing the late Queen Elizabeth II’s impact on the financial community.

This video is from the channel NewsClips on Brighteon.com.

More related articles:

British pound sterling’s value against the dollar falls to lowest level since 1985.

Cost of living reaches epic highs in UK, “widespread civil unrest” looming.

Sources include:

Submit a correction >>

Tagged Under:

big government, Collapse, crisis, debt collapse, economic collapse, economics, economy, energy crisis, energy prices, energy shortage, energy supply, fuel supply, government debt, Liz Truss, national debt, price controls, United Kingdom

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 POWER NEWS